XRP Price Prediction: Analyzing the Path to $3.65 and Beyond

#XRP

- Technical Consolidation: XRP is trading in a tight range between $2.79 support and $3.16 resistance, with MACD showing early bullish signs

- Fundamental Catalysts: Ripple's partnerships, regulatory clarity, and institutional participation through BlackRock/VanEck provide strong underlying support

- Market Sentiment: Whale activity and ETF speculation are creating positive momentum despite mixed technical signals

XRP Price Prediction

XRP Technical Analysis: Consolidation Phase Sets Stage for Potential Breakout

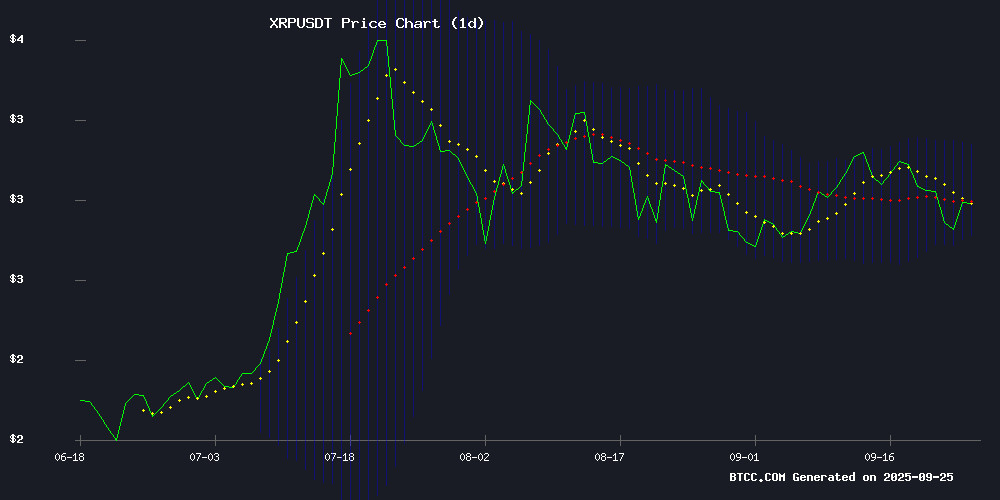

XRP is currently trading at $2.83, below its 20-day moving average of $2.97, indicating short-term bearish pressure. The MACD shows a bullish crossover with the histogram at +0.0406, suggesting potential upward momentum. Bollinger Bands reveal the price is trading NEAR the middle band, with resistance at $3.16 and support at $2.79. According to BTCC financial analyst Olivia, 'The technical setup suggests XRP is in a consolidation phase. A break above the 20-day MA could trigger a move toward the $3.16 resistance level.'

XRP Market Sentiment: Bullish Catalysts Outweigh Technical Weakness

Recent developments including Ripple's key partnerships, regulatory clarity, and institutional interest through BlackRock and VanEck funds are creating positive momentum. The integration with Flare Network and RLUSD stablecoin developments are expanding XRP's utility in DeFi. BTCC financial analyst Olivia notes, 'While technical indicators show mixed signals, the fundamental news flow is overwhelmingly positive. The $700M liquidity unlock and institutional participation could drive XRP toward the $3.65 breakout level.'

Factors Influencing XRP's Price

XRP Whale Transaction Sparks Bullish Momentum as Price Eyes $3.65 Breakout

XRP's market dynamics shifted notably as a whale moved 21.9 million tokens, triggering speculation of accumulation and impending volatility. Analysts point to bullish technical signals on the XRPBTC pair, reinforcing optimism for the altcoin's rally.

Trading at $2.85 with a $9.25 billion 24-hour volume, XRP's 2.12% gain reflects renewed market vigor. The community watches key resistance at $3.65, with large transactions historically influencing near-term sentiment and price action.

XRP Price Consolidates Amid Mixed Technical Signals

XRP hovers near $2.85 as traders digest conflicting technical indicators. The sixth-largest cryptocurrency shows neutral momentum with an RSI of 43, flirting with oversold territory while maintaining crucial support above its 200-day moving average at $2.54.

Binance spot markets recorded $401 million in XRP volume despite the absence of major catalysts. Market technicians note the bearish MACD divergence contrasts with the asset's ability to hold key support levels—a tension that typically precedes volatility breakouts.

Ripple Secures Key Partnerships Following XRP Regulatory Clarity

Ripple's legal victory against the SEC has catalyzed a wave of institutional adoption. The March 2025 court ruling distinguishing XRP's status for public versus institutional sales provided the clarity needed for major financial players to engage.

BNY Mellon's July 2025 appointment as custodian for Ripple USD (RLUSD) marks a watershed moment for crypto's integration with traditional finance. The $1.25 billion acquisition of Hidden Road further consolidates Ripple's position as a bridge between legacy systems and digital assets, with XRP Ledger serving as the institutional backbone.

Dubai's real estate tokenization initiative through Ctrl Alt demonstrates blockchain's expanding utility beyond payments. The revived partnership with CIBC—first established in 2016—signals renewed confidence among early institutional adopters.

Coinbase's XRP Holdings Drop to Zero as Institutional Demand Surges

Coinbase's cold wallets now show zero XRP holdings, a stark decline from nearly 970 million tokens worth $2.8 billion in June 2025. The outflow aligns with growing institutional appetite ahead of anticipated ETF approvals.

Data reveals a three-month drawdown pattern, with XRP moving first to hot wallets before disappearing into private custody. By September, only 32 million tokens remained across two public addresses—down 90% from June's peak.

Market analysts attribute the shift to OTC deals and institutional accumulation. The trend mirrors Bitcoin's pre-ETF trajectory, where asset managers secured positions months before regulatory greenlights.

Ripple and Securitize Unlock $700M RLUSD Liquidity with BlackRock and VanEck Funds

Ripple and Securitize have introduced a smart contract enabling instant swaps between BlackRock's BUIDL and VanEck's VBILL funds into Ripple USD (RLUSD), marking a significant leap in institutional blockchain adoption. The enterprise-grade stablecoin RLUSD, now with a $700 million market cap, bridges traditional finance and on-chain markets by providing round-the-clock liquidity while maintaining yield exposure.

The partnership underscores Ripple's focus on compliance and efficiency for institutional players. Senior VP Jack McDonald emphasized RLUSD's design purpose: "How do you unlock real-time liquidity for institutional assets? With $RLUSD." The integration into tokenized treasury funds signals growing convergence between TradFi and DeFi ecosystems.

XRP Holds Steady at $2.84 Amid ETF Speculation and Whale Activity

XRP has maintained a tight trading range around $2.84, oscillating between $2.80 and $3.10 as the market processes institutional adoption news and ETF speculation. Despite sell-offs by large holders, the cryptocurrency remains in focus due to its expanding ecosystem and heightened investor interest.

Ripple's recent partnerships with DBS and Franklin Templeton highlight XRP's growing role in enterprise finance. The collaboration enables tokenized money market fund trading on the XRP Ledger, bolstering its utility beyond speculative trading. The inclusion of Ripple's RLUSD stablecoin further strengthens the infrastructure for institutional adoption.

ETF-related momentum has driven increased trading volumes, signaling broader market interest. Analysts view the potential spot XRP ETF as a catalyst for further adoption, with the token's credibility and market presence poised for expansion.

XRP Price Prediction: Analyst Foresees Potential 1,600% Rally Despite Recent Breakdown

EGRAG CRYPTO's analysis suggests XRP could mirror historic rallies, targeting $9.6 to $33 despite a recent drop below $3. The 21-day EMA, a critical support level in 2017 and 2021 cycles, was retested on June 9, 2025—a bullish signal if maintained.

Current trading at $2.82 reflects resilience after a $2.70 dip triggered $1.6 billion in liquidations. Bollinger Bands indicate strong support at $2.70, with price action confined between $2.77 and $2.96 this month. Weekly charts reinforce optimism, though speculative targets remain contentious.

XRP Integrates with Flare Network to Access DeFi Ecosystem

XRP holders now have a gateway into decentralized finance as Flare Network launches its FAssets protocol with FXRP v1.2. The move enables XRP—long confined to settlement use cases—to function as collateral, liquidity, and yield-bearing asset through an ERC-20 wrapped version.

The rollout follows rigorous testing on Flare's Songbird canary network, with initial minting capped at 5 million FXRP as a risk control measure. Security relies on a tripartite system of agents, collateral pools, and Flare's proprietary data oracles.

Market observers question whether this belated DeFi entry can revive XRP's stagnant price action. The token remains down 85% from its 2018 peak despite Ripple's recent legal victories against the SEC.

Ripple's RLUSD Stablecoin Integrates Blackrock and Vaneck Tokenized Assets for Institutional Liquidity

Ripple's enterprise stablecoin RLUSD is bridging traditional finance and decentralized ecosystems by enabling 24/7 access to Blackrock's BUIDL and Vaneck's VBILL tokenized funds. The integration with Securitize's platform allows instant conversion between these Treasury-backed tokens and RLUSD, creating an always-on liquidity channel for institutional investors.

The move signals accelerating institutional adoption of blockchain for real-world asset tokenization. Blackrock's USD Institutional Digital Liquidity Fund and Vaneck's Treasury Fund Ltd. represent major TradFi players entering on-chain finance, with RLUSD serving as the compliant bridge. The stablecoin maintains 1:1 backing under NYDFS oversight, meeting corporate treasury requirements.

This development underscores how regulated stablecoins are becoming critical infrastructure for institutional DeFi participation. The ability to seamlessly move between tokenized Treasuries and stablecoins unlocks new possibilities for yield strategies and risk management in digital asset portfolios.

XRP Mining Contracts Offer Daily Earnings Amid Market Volatility

Ripple's XRP token is gaining renewed attention as FuturoMining launches dedicated cloud mining contracts, promising holders potential earnings of $6,700 daily. The offering emerges as global cryptocurrency markets face heightened volatility, with XRP's role in cross-border payments and fintech infrastructure drawing investor interest.

XRP has weathered regulatory challenges since 2020, including its high-profile SEC lawsuit, yet market participants are increasingly recognizing its long-term potential. The token's fast settlement times and low transaction costs position it as a growing force in payment systems and decentralized applications.

Analysts suggest XRP could become the standard conduit for crypto payments as blockchain technology gains mainstream financial adoption. This outlook comes as platforms like FuturoMining create new avenues for exposure to the asset beyond direct trading.

XRP Ledger Rockets Into Top 10 With $1B Stablecoin Surge, Ripple Pushes Institutional DeFi

The XRP Ledger has achieved a significant milestone, surpassing $1 billion in monthly stablecoin volume and securing a position among the top 10 blockchains for real-world assets. This growth underscores its emergence as a trusted settlement layer for both regulated institutions and crypto-native platforms.

Ripple has unveiled an ambitious roadmap, introducing new features such as credentials, Deep Freeze, and a native lending protocol. These advancements aim to enhance the ledger's utility, with a particular focus on stablecoin payments and collateral management.

Institutional DeFi is transitioning from pilot programs to large-scale adoption, with compliance as a cornerstone. Ripple reports that this shift is now driving billion-dollar volumes across global markets, marking a pivotal moment for the ecosystem.

The XRP Ledger's progress is intrinsically linked to the utility of XRP, reinforcing its role in the evolving digital asset landscape. Tokenization remains central to its strategy, positioning the ledger at the forefront of financial innovation.

How High Will XRP Price Go?

Based on current technical and fundamental analysis, XRP shows potential for significant upward movement. The current price of $2.83 faces immediate resistance at the 20-day MA of $2.97, with stronger resistance at the Bollinger Band upper level of $3.16. A successful break above these levels could target the $3.65 breakout mentioned in recent news.

| Price Level | Significance | Probability |

|---|---|---|

| $2.79 | Strong Support (Bollinger Lower) | High |

| $2.97 | 20-day MA Resistance | Medium |

| $3.16 | Upper Bollinger Resistance | Medium |

| $3.65 | Breakout Target | Low-Medium |

BTCC financial analyst Olivia suggests that 'The combination of technical consolidation and strong fundamental catalysts creates a favorable environment for XRP. While short-term movement may be constrained, the medium-term outlook appears bullish with proper risk management.'